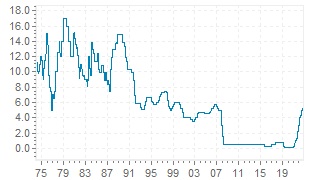

Bank of England base rate

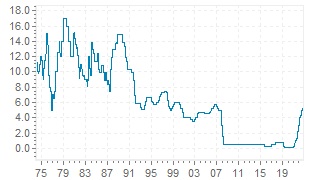

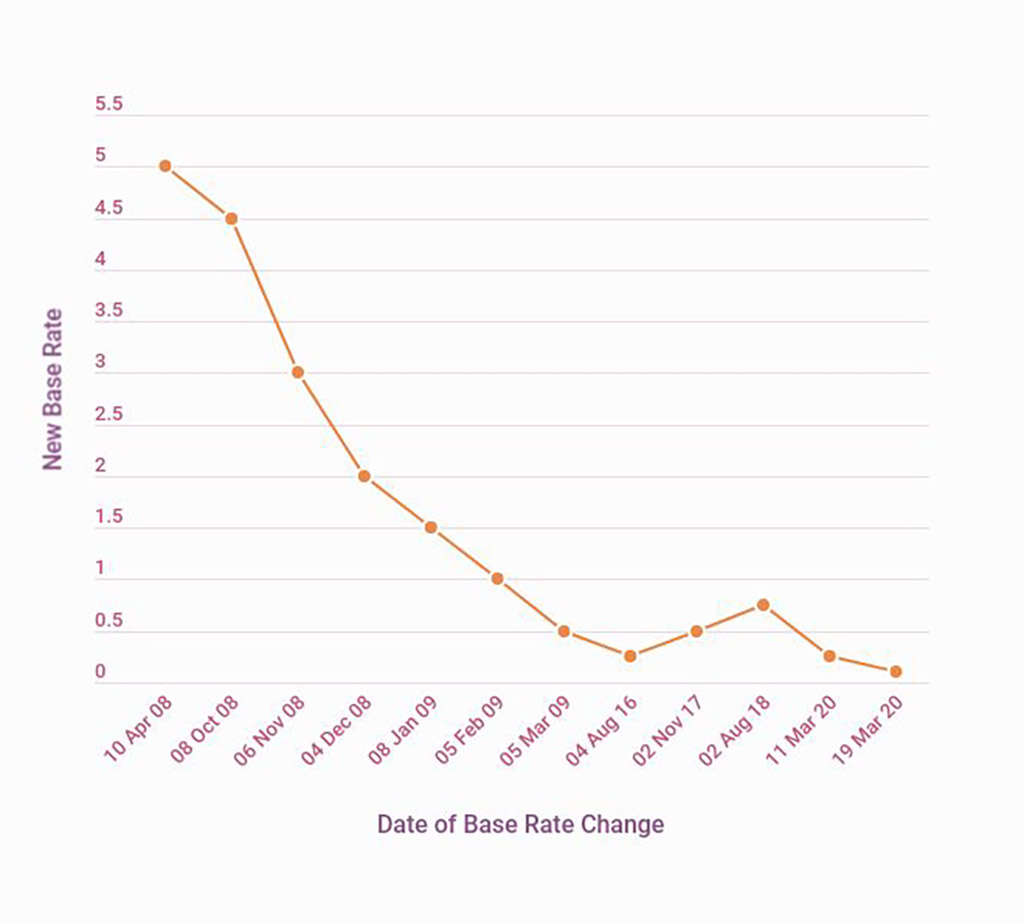

On 3 February The Bank of England raised its base rate from 025 to 05. Prior to the event money markets were pricing in 5 hikes from the BoE in 2022 At 05 the BoE can opt to end reinvestment of maturing assets Reminder there is 28bln worth of gilt maturities in March.

It is our job to set this interest rate.

. The Bank of England raised the base rate from 025 per cent to 05 per cent at 12pm today Thursday 3 February. Includes the Base Rate increase to 050 in February 2022 and MPC meeting dates for 2022. This increase represents the first back-to-back rise in interest rates since 2004 after the MPC elected to up rates from 01 to 025 in December.

We may need to raise interest rates somewhat further. We have raised the official interest rate we set known as Bank Rate to 05 to support inflation returning to our 2 target. Think of a shopping basket filled with items that nearly everyone buys.

The base rate which affects the rates banks offer for mortgages and savings had previously been at a historic low of 01 since the beginning of the Covid-19 pandemic in March 2020. It strongly influences UK interest rates offered by mortgage lenders and monthly repayments. Our job is to ensure that inflation returns to our target in a sustainable way.

The MPC also voted in favour of unwinding Quantitative. What the Bank of England base rate rise means for your mortgage The base rate rise will hit those on SVRs but even if you have fixed you will soon have to pay more. Bank Of England Raises Bank Rate By 25Bps To 050 From 025 - Voted 5-4 To Raise Bank Rate.

The Bank of England base rate is usually voted on by the Monetary Policy Committee MPC eight times a year. The Bank of England Monetary Policy Committee had an emergency call this morning so that rate cuts and further quantitative easing could be agreed and announced with the Bank needing to be on. Bank Rate is the single most important interest rate in the UK.

Its been a month since the Bank of England increased the base rate to 025 but savers are still not benefitting from the 015 percentage point rise Which. Bank Rate influences lots of other interest rates in the economy. However the committee has the power to make unscheduled changes to the base rate if they think it necessary.

The base rate is the Bank of Englands official borrowing rate. Its the second time in two meetings of the Monetary Policy. The Bank of Englands BoE Monetary Policy Committee MPC has voted to increase the base rate from 025 to 050.

In the news its sometimes called the Bank of England Base Rate or even just the interest rate. The members of the committee that voted against actually wanted to increase the rate by 05 to 075 so the Doves actually prevailed despite the increase. It is currently 05.

Interest rate hike is coming get ready. We explain why we decide to keep the rate the same or change it in our Monetary Policy Report. The Bank of Englands Monetary Policy Committee MPC has voted by a majority of 5-4 to increase Bank Base Rate by 025 percentage points to 05.

The MPC used this power in March 2020 when it reduced the base rate due to the potential effects of the coronavirus on. Discover what the current Bank of England base rate is when the next Bank of England MPC meeting is when the interest rate could increase how the base rate can affect your mortgage and how it is affected by Brexit and coronavirus. Economists widely predicted the.

City bets on imminent Bank of England rise THE Bank of England is expected to implement an interest rate hike at its meeting next week. Inflation is the rate of increase in.

Boe Official Bank Rate British Central Bank S Current And Historic Interest Rates

Bank Of England Base Rate Money Co Uk

Why Have Interest Rates Been Slashed And What Will The Impact Be The Independent The Independent

Negative Rates Explained Should Uk Investors Prepare Institutioneel Schroders

How The Bank Of England Set Interest Rates Economics Help

Visual Summary Inflation Report August 2019 Bank Of England

Post a Comment

Post a Comment